Your Trusted Investment Partner

Customised mutual fund portfolios for long-term wealth creation

200+

Clients served

₹ 80+ Cr

in assets under management

5+

Years of wealth management experience

Multi Asset – Conservative

Portfolios designed to protect your wealth.

Real-time portfolio monitoring by professionals.

Human support whenever you need it.

Timely recommendations & rebalancing updates.

Equity mutual funds + Debt + Commodities.

Multi Asset – Growth

Portfolios designed to grow your wealth.

Focused on higher returns while minimising risk.

Professionals track the market’s impact on your portfolio daily.

Portfolios optimised for tax efficiency.

Equity mutual funds + Debt.

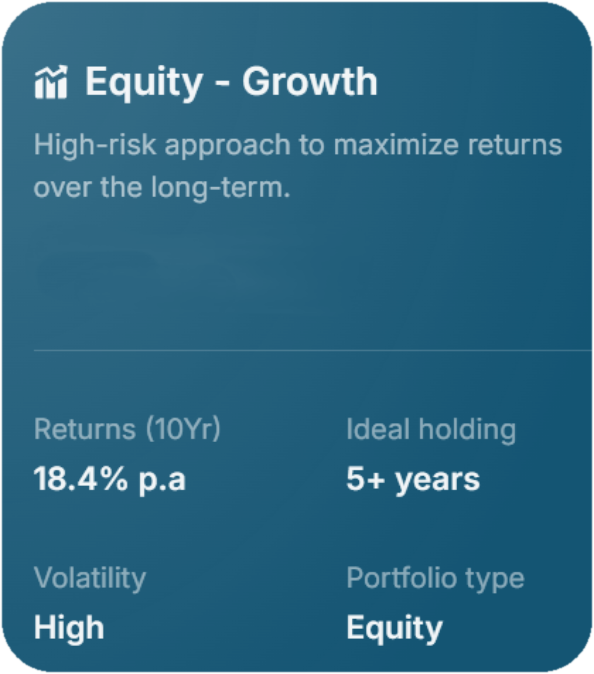

Equity – Growth

Portfolios designed to maximize returns over the long-term.

High-risk approach.

Actively managed by professionals.

Automatically capitalising on opportunities.

Equity mutual funds + Global mutual funds

Existing Investments

Analyse & improve

your current portfolio

Get a free detailed review of your current investments

Discuss your financial goals with us

Book a free 1-1 call to get actionable insights on growing your wealth

Our Founder

Aakash is the founder of JK Capital. He has over 5 years of experience in private wealth management. Aakash has previously managed money for some of the wealthiest Indians, across geographies and businesses.

Aakash holds a gold medal in Computer Science & Engineering and is a CFA Charter Holder. He is an active volunteer at the CFA Society India.

Aakash Goel, CFA

Founder

About JK Capital

We are a new age, focused wealth management firm that combines the expertise of seasoned investment professionals with advanced technology to provide comprehensive investment solutions. We build and manage diversified portfolios, that help you create long-term wealth and achieve your financial goals.

Our team of professionals monitor the performance of your portfolios and rebalance them whenever required to ensure long-term success. Our goal is to help you grow your wealth without the stress, time, and costs involved, so you can focus on what matters most to you.

FAQs?

Why should I trust JK Capital with my money?

JK Capital is a client-centric wealth management platform that believes in placing our clients’ interests front and centre. Our team of seasoned investment professionals with 5+ years of experience in the investment industry offer highly personalised solutions to our clients ensuring maximum transparency.

Is it safe to invest with JK Capital?

Yes, it is safe to invest with JK Capital. We are a regulated intermediary where all your investments are held under your name and you are always the rightful owner of your investments.

Is JK Capital regulated?

Yes, we are regulated by the Association of Mutual Funds in India (AMFI) with AMFI Registration No. ARN-252668. Mutual Funds are highly regulated and investors are protected by AMFI.

Why should I invest with JK Capital and not a large bank?

A large bank faces a conflict of interest in promoting products, as they tend to recommend options that generate the highest fee income. Whereas, we at JK Capital believe in recommending the right products to our clients without being influenced by fee income considerations.

How does JK Capital make money?

We don’t charge anything from our clients for the services that we offer. We earn our revenues from the Mutual Fund companies.

Is there any guarantee of returns?

No, Mutual Funds do not guarantee returns. Their performance is influenced by market conditions and various economic factors. While they offer the potential for growth, investing in Mutual Funds carries inherent risks. Investors should assess their risk tolerance and investment goals carefully.

What is the minimum amount required to invest with JK Capital?

We at JK Capital offer 2 products, each with a different minimum investment required.

- JK Capital SMART (Personalised Mutual Fund portfolios): Rs. 50,000

- JK Capital SELECT (Bespoke Private Wealth): Rs. 20 Lakhs

What happens to my money if JK Capital goes Bankrupt?

JK Capital helps you invest your money in the right way. The money is invested in Mutual Funds under your name. In the unlikely event of JK Capital’s bankruptcy, your funds remain secure and unaffected. You retain full control with the ability to manage or withdraw your money directly from the websites of Mutual Fund companies or trusted registrar & transfer agents like CAMS and KFintech.